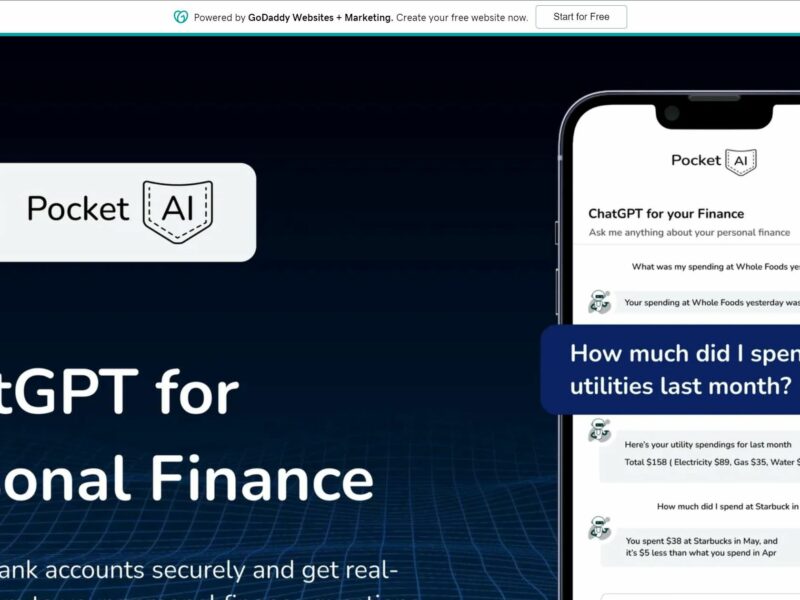

Pocket AI

Pocket is the ultimate personal finance chatbot, revolutionizing the way users manage their money. Powered by AI and leveraging a trusted partner, PLAID, Pocket offers seamless integration with credit cards and bank accounts to provide instant financial answers and insights.

Key Features:

- Immediate Financial Answers: By connecting with credit cards and bank accounts, Pocket delivers instant answers to users’ financial queries, available 24/7.

- Trusted Data Source: Through PLAID, Pocket securely accesses transaction history and pre-built analytics dashboards, ensuring reliable and accurate financial insights.

- Natural Language Processing: Pocket utilizes natural language processing to understand users’ questions, enabling personalized responses based on their financial data.

- Real-time Financial Insights: Gain real-time insights into spending habits, helping users become more aware of their financial behavior and make informed changes.

- Time-saving: Eliminate manual tracking of finances with Pocket’s convenience, saving time and energy in managing financial transactions.

- Cross-device Accessibility: Access financial information and insights conveniently through Pocket on mobile devices or desktop computers.

User Benefits:

- Increased Financial Awareness: Real-time insights empower users to understand their spending habits, fostering better financial behavior.

- Efficiency: Pocket saves time and effort by eliminating the need for manual tracking and providing immediate answers.

- Convenience: Access financial data anytime, anywhere, enhancing user control and decision-making.

- Comprehensive Analytics: Detailed transaction analytics, spending by merchant, and income-expense tracking by category.

Pocket is a game-changer in personal finance management, harnessing AI and trusted partner PLAID to deliver instant financial answers and real-time insights. By connecting credit cards and bank accounts, users gain valuable financial awareness, save time, and access comprehensive analytics. Pocket’s intuitive interface and natural language processing ensure that users can effortlessly manage their finances, make informed decisions, and improve their financial behavior.